TBLS- ESG Valuation for Private and Public Equities

Managing Operational & Reputation Risks in Investment

A Case for Integrating ESG into Financial Analysis

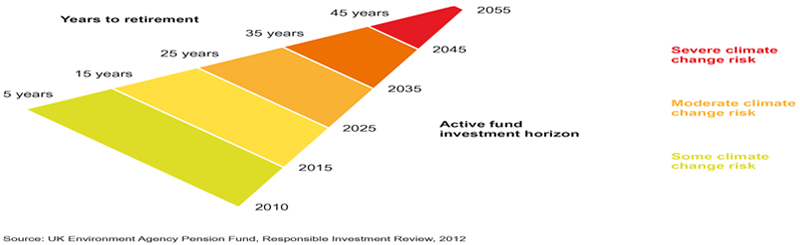

There is increasing evidence that Environmental, Social, and Governance (ESG) issues are financially-material and can significantly affect a corporation’s bottom line, stakeholder value and reputation in the eyes of investors and stakeholders. BP’s losses from the Deepwater oil spill cost shareholders over $60b in lost stock value, or 2-3 times the costs directly incurred by BP for the cleanup. At the height of the 2008 recession, sustainable enterprises as a group outperformed peer companies by as much as 15%. As reputation and brand value and other intangible values are an increasingly larger portion of a firm’s value (81% vs. 17% 30 years[Office1] ago), large institutional investors such as pension funds, endowments and sovereign wealth funds are increasingly interested not just in maximizing financial returns, but also in understanding the ESG-related risks of the companies that they invest in, and the ESG risks of the private & public equity funds in which they invest.

Generating Triple Bottom Line Returns and Minimizing Risks

Private equity firms such as KKR, Carlyle and TPG are integrating ESG risk and opportunity valuation into their assessments of the firms in their PE portfolios, as well as in due diligence for potential acquisitions, and valuation of portfolio asset disposals. Active and passive public equity, real estate and fixed income investment funds are also being asked by activist investors as to the ESG risks hidden within their portfolios. The Triple Bottom Line Strategies (TBLS) Group asserts that sustainability issues are key to both the short-term bottom line, and long-term value, of a corporation. We help prioritize sustainability initiatives to produce both the strongest ROI and/or enhancement of intangible values such as reputation. We are familiar with the wide variety of approaches for valuing ESG risks and opportunities, and can calculate the bottom-line value of improving corporate sustainable performance. Our clients have access to our interdisciplinary resources and expertise in this area that can be used to support in-house efforts that are cost-effective, efficient and scalable.

A Team of Experts from ESG Metrics to ESG Integration

TBLS today has expertise in Sustainable Finance, Ratings, Metrics, Marketing, Opportunity/Risk Management, Marketing & Valuation Services. Our experts are independent leaders in industry, academia, and consulting with backgrounds at multinational industrial firms, environmental and regulatory agencies, and insurance and financial services firms. We are committed to results and to bringing to clients powerful integrated sustainability programs.